By Yiep Joseph

The business community has criticized the Ministry of Finance and Planning and the Bank of South Sudan over black-market dealings.

The group claimed that the two institutions kept deaf ears on some of the emerging issues in the black market.

As the country faces economic challenges, the business community has proposed the need for urgent stakeholders’ engagement to address the crisis.

South Sudan has continued to face depreciation of South Sudanese Pounds (SSP) against other major currencies like the United States Dollar.

Due to the depreciation of SSP, commodities in the local market continue to increase, making it hard for some of the citizen to afford basic needs.

In addition, the civil servant and organized forces have gone for some time without salaries, a situation blamed on limited resources and a liquidity crisis in the country.

Addressing the media over the weekend, Ayii Duang Ayii, the chairperson of South Sudan’s business community, criticized the Ministry of Finance and Planning and the Bank of South Sudan (BoSS) over black market dealings.

Duang claimed that there have been new banknotes in the black market with no cash in the commercial bank.

According to Duang, such a situation has contributed to the cash shortage.

He accused the officials at the Ministry of Finance and Planning as well as the Bank of South Sudan to be behind such practices, citing that they have knowledge of such black-market dealings.

Duang claimed that some officials take money meant for circulation to blank market so that they can get profits.

Efforts by this outlet to reach the Ministry of Finance and Planning as well as the Bank of South Sudan to respond to accusations were not successful at press time.

The Chairperson of the Business Community questioned the two institutions to explain why there are new SSP notes in the black market rather than in commercial banks.

“If you go to the black market, you get the new SSP notes of recent but no cash in commercial banks. Where is this money coming from? The Ministry of Finance and Planning as well as the Bank of South Sudan must answer this question,” Duang said.

He added that the citizen continues to suffer due to the liquidity crisis in banks where there are banknotes on the streets of Juba.

“It is a very unfortunate situation; you cannot withdraw your own money from the bank, while you can see a lot of SSP on the streets, and you wonder where they are coming from,” he said.

The chairperson of the business community called on the financial institutions to double efforts in solving the economic crisis in the country.

Calls for joint efforts to tackle economic crisis

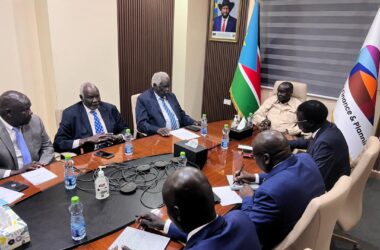

With hope to improve the economic situation in the country, the business community recently started their engagement with finance institutions in the country.

The institutions include the Ministry of Finance and Planning, the Central Bank, and others.

The chairperson of the business community revealed that, in line with the SPLM’s recent meeting to handle the economic crisis, the group has engaged the financial institutions for the meeting.

Duang expressed that their meeting was intended to strategize on the way forward in resolving the ongoing economic crisis in the country.

However, according to the chairperson, the Minister of Finance and Planning downplays the request to meet with the business community in order to initiate solutions to the economic crisis.

“We organized ourselves to meet the Minister of Finance and Planning in order to team up toward solving the ongoing economic crisis, but he seemed to downplay and refuse,” he claimed.

The business community leader called on the minister and the governor of the bank to cooperate with them, citing that their cooperation will contribute to solving the current economic situation.

Duang reiterated commitment toward rescuing South Sudanese from the ongoing economic crisis that has affected most of the families.

“As a business commodity, we remain committed to rescuing our people from economic crisis and from high prices,” he said.

He added that previously the leadership of the business community tried hard to resolve the case of interest rates, where people with cash could request interest as high as 20%.

The business community leaders revealed that such success was achieved after the business community engaged the Ministry of Finance and Planning and the Bank of South Sudan, which responded quickly regarding the issues of interest rates.

Duang called on the government officials in different offices to cooperate with the business community in order to have a solution to the economic crisis.

“As a business community, we are willing to cooperate, and we call on all the officials to cooperate with us in order to get a permanent solution to the ongoing economic crisis,” he said.

He added that his leadership remains committed to working hand in hand with the government in order to ensure essential communities become available and affordable.

According to Duang, the business community leadership has consistently engaged the business people in regard to lowering prices of the essential goods.