By Alan Clement

TNLA lawmakers have proposed a currency change to tackle South Sudan’s worsening liquidity crisis, which has hindered salary access for civil servants and members of parliament.

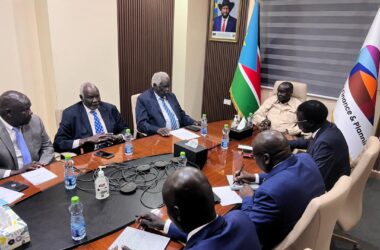

The proposal emerged during the 12th Ordinary Sitting of the TNLA on Monday, September 1st, 2025, following a motion tabled by Michael Ruot Koryom, MP for Nyirol County, Jonglei State.

The motion highlighted the recent transfer of salaries from the Central Bank to commercial banks, which have since imposed restrictive withdrawal limits dropping from SSP 500,000 to SSP 50,000 citing cash shortages.

Julius Ajeo Moilinga, MP for Magwi County, said the lack of currency circulation posed a national risk that could amount to sabotage. He proposed that the government print new banknotes and give citizens a short window to exchange old bills.

“By doing so, the holders of the money must be given seven days to bring all their money to the bank to be exchanged with the new capital. Then you will see the mountains of notes coming to the bank,” Moilinga argued.

The proposal was backed by John Badeng of Jonglei State who argued that a currency change would compel those hoarding money to return it to the formal banking system, enabling the Central Bank to regulate distribution more effectively. “People keeping money in the house will rush to replace the old currency,” he said.

However, in an exclusive interview with No.1 Citizen Newspaper regarding the proposal, South Sudanese economist Dr. Abraham Maliet Mamer, cautioned that currency reform is not within the purview of Parliament.

He emphasized that such decisions rest with the executive, and must follow a thorough investigation into the root causes of the liquidity crisis.

“Currency change is not the role of Parliament,” Dr. Mamer explained. “It must be initiated by the executive through the Bank of South Sudan and the Ministry of Finance and only after all avenues have been exhausted. Announcing it publicly invites speculation and counterfeiting, which can destabilize the system.”

Dr. Mamer also defended the withdrawal limits imposed by commercial banks, stating they are designed to ensure equitable access to limited cash reserves. He noted that in times of scarcity, rationing is necessary to prevent a few individuals from monopolizing available funds.

“These restrictions are not meant to punish anyone,” he said adding that, “they are a way to ensure equity so that everyone gets something, even if it’s small. It’s a necessity, not a choice.”

During the deliberations, other lawmakers focused on the broader implications of the crisis. Betty Achan Akwaro from Eastern Equatoria State criticized commercial banks for charging withdrawal fees and failing to offer interest on savings.

“Banks are consuming the little people have. Why would anyone keep their money in a bank that charges them for withdrawing it?” she asked. “The Central Bank must instruct commercial banks to return interest to depositors to make banking attractive again.”

Joyce Dusman of Lainya County demanded transparency on the whereabouts of public deposits and questioned the source of funds used in Central Bank auction while Chagor Guach and MP from Abyei raised concerns about South Sudanese pounds reportedly circulating in Darfur, in areas controlled by Sudan’s Rapid Support Forces.

“We need the Financial Intelligence Unit to investigate and support this House in understanding where our money is going,” Chagor said.

Deputy Speaker Parmena Awerial who presided over the day’s session backed the motion’s urgency remaking that, “This is a very important and urgent topic. We will request the Minister of Parliamentary Affairs to summon the concerned institutions, including the Financial Intelligence Unit, to explain where the money has gone.”

The House resolved to summon the Minister of Finance and Planning, the Governor of the Central Bank, and relevant financial oversight bodies to present a comprehensive report on the liquidity crisis and assess the feasibility of currency reform.

The motion signals growing legislative momentum for structural financial changes aimed at restoring public confidence and economic stability.