By Kei Emmanuel Duku

MTN Mobile Money (MoMo) customers across South Sudan have been hit by a severe liquidity crisis and a widespread service failure just months after the mobile money services were introduced, effectively trapping digital funds and paralyzing small-scale commerce.

The resulting outage has left many MTN subscribers unable to withdraw cash at MoMo agent points and sometimes unable to carry out e-commerce transactions at major stalls within the city as section of traders shunned the system.

Customers are consistently being turned away due to a critical lack of available physical cash, a problem that is exacerbating existing economic challenges.

The system breakdown, which has persisted for over a month now, has resulted in thousands of users being unable to withdraw cash; agents are only accepting deposits and transfers of cash between subscribers. This failure has caused a negative impact on the local economy, which heavily relies on mobile money for daily transactions due to limited banking access.

The failure of the MTN MoMo service comes at a time when the mobile telecommunication company is celebrating 4 million subscribers since its establishment in South Sudan.

Christin Keji, a street vendor in Juba City, stated that she lost hope in the poor services offered by MTN after subscribing to MoMo in 2018. Her disillusionment is due to the constant denial of access to her money, even when she goes to any registered MTN Agent in Juba.

Keji recounted an instance of service denial: “I have no interest in MoMo but my colleague forced me to register for MoMo because she doesn’t have a phone and her relative wants to send her money. After subscribing, since then I was unable to withdraw the money and give the owner. Now I have been forced to pay the owner of the money because I just simply own the SIM card,” said Keji.

Keji stated that since that incident, she decided to discard her MTN SIM Card not only because of the poor mobile money services MTN offers but also due to its high tariffs. She specifically complained that when she borrows airtime for an emergency and later recharges her phone, MTN will double the charges or sometimes deduct the entire amount of money loaded.

She elaborated: “You borrowed 500 South Sudanese Pounds and later on recharge with more than 500—for example, 1,000 or 2,000. Instead of deducting 500, MTN will chop all the amount of money you have subscribed with at that particular time,” she added.

The street vendor believes that the interest charged should be proportionate to the figure borrowed. “This is bright day robbery which MTN should reduce or work on it. They can’t operate like a bank. How can you deduct more than or double what I have as a client borrowed? For example, if I borrowed 500 pounds, at least I should be able to pay an interest of 50-100 pounds; this is a reasonable charge,” stated Keji.

Meanwhile, Peter Sebit Angelino, a Boda Boda rider in Juba town, said he has been using an MTN SIM Card for the last three years but has been unable to register for MTN MoMo Mobile services due to his limited sources of income.

Although Angelino said he has not personally tried to withdraw or deposit money using MTN MoMo services, he has been hearing complaints about the lack of cash whenever MTN subscribers go to withdraw money from MTN Mobile Money agents or Forex Bureaus.

Angelino expressed his surprise at the situation: “I am surprised MTN customers are complaining outside here about lack of cash, but right now if you go to their main office, people are withdrawing cash in bulk and carrying it in sacks, so I didn’t know how the system is operating,” he said.

Peter Lemi, a resident of Suk Mamur in the Jebel area, also expressed his dissatisfaction over the poor MoMo service offered by MTN Telecommunication Company.

“The biggest problem with MoMo is withdrawal. You can deposit as much as you can, but when you want to withdraw, every shop or registered agent you visit will tell you there is no cash. Even if you deposit now without taking a single step, and your cash is still lying on the table or with the cashier, they will tell you no cash,” said Lemi.

Lemi currently has about 300,000 Pounds (50$) in his MTN account which he has been unable to withdraw for the last two to three months.

The Boda Boda rider urged the telecom company to make life simpler for its customers, or they risk losing customers if they cannot address the challenges associated with MTN MoMo mobile services. He sarcastically noted the inconsistency between the company’s promise and the reality: “Their slogan is ‘MTN everywhere you go,’ unfortunately with cash, everywhere you go, there is no money,” he added.

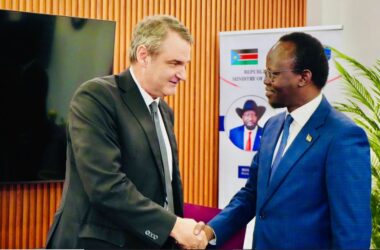

When responding to queries on Monday, October 20, 2025, Henry Njoroge, MTN Chief Marketing Officer, stated that the company does not print money; rather, it is just facilitating the process of money transfer and withdrawal.

He, however, urged customers who can’t withdraw their cash physically to transact digitally: “If you don’t have access, you actually don’t have to actually take the money out, you can even use it to pay other things. At the moment, we are increasing coverage because cash is going to be a problem for some time,” noted Njoroge.

Mid this year, the Bank of South Sudan (BoSS) issued a statement affirming Mobile Money as a legal tender and a valid form of payment for goods and services throughout the country.

According to the circular, the move is part of the government’s strategic plan to modernize the financial sector and reduce reliance on physical cash. The Bank went on to state that refusing to accept Mobile Money for transactions could be considered an offense.