By Lodu William Odiya

The South Sudan Revenue Authority (SSRA) has revealed a remarkable progress in national revenue collection, financial management, and institutional governance, marking a major milestone in the country’s economic reform efforts.

In a press statement signed by Commissioner General Simon Akuei Deng, the South Sudan Revenue Authority’s revenue collection has grown from an average of 3 billion South Sudanese Pounds (SSP) per month in 2020 to an unparalleled 130 billion SSP as of October 2025.

“Under the visionary leadership of the government and through the collaboration between the Ministry of Communication and information and the SSRA, a sweeping digital transformation has reshaped the national revenue landscape” the statement read.

The program introduced modern systems that enhanced transparency, accountability, and data-driven fiscal management across ministries and public institutions.

Furthermore, the statement emphasized that the South Sudan Revenue Authority (SSRA) reiterated that its focus remains on promoting transparency, enhancing institutional efficiency, and ensuring sustainable revenue growth to support essential public services and national development.

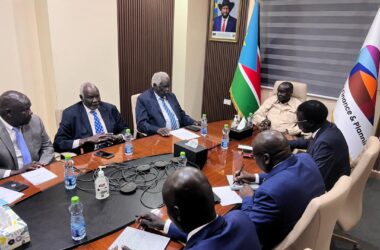

Early this Month, the South Sudan Revenue Authority (SSRA), in partnership with the National Communication Authority (NCA), has signed a six-year agreement with Ensoft, a global provider of digital assurance systems, to enhance transparency and efficiency in tax collection.

Under the agreement, ESoft will receive 3.56 percent of all revenue collected through the system, with the remaining 96.44 percent going to the government represented by SSRA and NCA.

For years, South Sudan’s financial system has relied heavily on cash, making transactions slow, expensive, and difficult to track.

According to the World Bank Database, over 70% of adults in the country lacked access to formal banking services in 2017.

As a result of this, mobile money services like MTN and Zain operated separately, increasing costs and limiting access.

With most payments happening in cash, businesses and individuals were able to avoid taxes easily which led to lost government revenue.

In 2019, mobile money platforms like m-Gurush and NilePay launched, offering more financial options. However, without a unified system, transactions remained inefficient, and tax collection persisted as a challenge. The government struggled to track business activities, allowing tax evasion to thrive.

In a country like Kenya, the rise of M-Pesa helped improve tax monitoring, leading to increased tax revenue from mobile transactions.

By 2020, Kenya collected over $200 million from digital transactions alone and this growth was attributed to the seamless tracking of transactions facilitated by M-Pesa.

South Sudan can achieve similar success when it sustained the ESoft system where every digital payment creates a record accessible to tax authorities.