By Kei Emmanuel Duku

The Commissioner of Domestic Taxes at the South Sudan Revenue Authority (SSRA), Chol Paul Kur, has revealed that the majority of foreign employees operating within the private and humanitarian sectors in the country are under-declaring their tax liabilities, constituting a significant loss of national revenue.

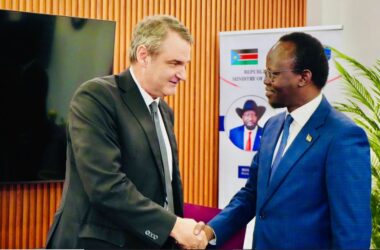

Commissioner Kur made the accusation during a high-level consultative meeting in Juba focused on Labor Migrants and Work Permits issues affecting South Sudan’s labor market.

The Commissioner stated that SSRA’s tax collection efforts are disproportionately relying on South Sudanese citizens, while foreign staff who often receive higher pay are dodging their obligations.

“Those whom we are collecting taxes from them are our own citizens. But majority of the foreign employees within the country, they are under declaring the tax liability when it is actually they are the one who are getting more pay than our national staff or our own citizen,” Kur told the meeting.

He pointed out that high-level positions in both the private and aid sectors, often occupied by foreign nationals, are not contributing through tax compliance, even though the labor market is a critical pillar of national development.

“When we are collecting taxes, we always get a feedback from our public that they are being mistreated by those who are occupying the high level positions. And those who are occupying the high level in both private and aid sector are not paying taxes.”

Kur appreciated the Ministry of Labor’s efforts to digitalize the labor market, suggesting it could help regulate the sector and ensure economic benefits for South Sudanese citizens and revenue benefits for the government. He urged the Ministry to benchmark practices from regional neighbors like Uganda and Kenya.

He admitted that the lack of cooperation among other government agencies and partners is hindering progress, despite SSRA embracing digital payment for visas and work permits.

“We are facing the difficulty in deporting of those who are not complying with the policies of the government and it has become a rampant issue,” he noted, emphasizing that only full digitalization of tax collection processes can minimize these systemic weaknesses.

Adding to the concerns, Duop Uluak Keat, Director of Hotels Security Department at the National Security Services-Internal Security Bureau (NSS-ISB), highlighted the severe challenges faced by South Sudanese workers, especially in the hotel industry, citing issues related to contracts and safety.

Uluak issued a strong challenge regarding the registration of business entities, accusing many organizations that come to South Sudan of arriving “empty handed without any capital for investment but they regard themselves as investors.”

“I never seen any investor in any other country that comes without any money and you allow that person to enter your own country. Really there is a need for the Minister of Justice to revise the registration policies,” Uluak demanded.

He also raised the issue of discrimination, stating that South Sudanese nationals are being mistreated by foreigners. He noted that while technical positions can justify importing experts, foreigners are even bringing in their own security personnel, which requires urgent attention.

Uluak appealed for an end to the lack of coordination in taxation between state and national governments, citing the recent conflict between Central Equatorial State authorities and the national government that led to the closure of some hotels.

He recommended the relevant entities sit down to create a unified, single channel for all tax payments to end the current multiple demands on businesses.

In his contribution to the meeting, Albino Akol Atak Mayom, the Minister of Humanitarian Affairs and Disaster Management, called for a thorough review of the country’s laws to ensure consistency and effective implementation of labor regulations.

He pointed out a significant contradiction in the issuance of work permits, particularly for citizens of East African countries who benefit from free movement agreements.

Minister Mayom explained the paradox: “Those who are in East Africa, they are free to come in. But when they are here, they are supposed not to acquire a work, and then later on acquire a work permit, because they are here but they can be told to go back first to their respective countries origin and apply for work permit before coming to work in South Sudan.”

He stressed the need for harmonization by the Ministry of Justice to clarify whether individuals must apply for and acquire a work permit before arriving in South Sudan to ensure legal compliance.

Meanwhile, the National Minister of Labor, James Hoth Mai, attributed the widespread tax evasion by foreign nationals primarily to a lack of coordination between government bodies, particularly citing the failure of Parliament to consult the Ministry of Labor before allocating high fees for visas and work permits.

Minister Mai argued that the Ministry of Labor is mandated to advise the government on contract issues, labor-related foreign policy, and most critically, tax exemptions and attractive investment packages. This mandate is designed to attract foreign capital without scaring away potential investors.

“Even if we say let’s exempt these people, because what they are bringing in will benefit us more than we tax them,” Mai explained. “Sometimes things are done without consulting us.”

The Minister asserted that the Parliament’s practice of enacting high fees for work permits without consulting the Ministry is counterproductive and harmful to the economy.

“So, what happens when the Parliament goes and enacts high Fees of Work Permit? Now people don’t come. What will the local population do with our situation here in the country?” he questioned.

Mai further charged that these high fees passed by Parliament have significantly contributed to corruption among immigration police and other security personnel at border points. He detailed how the excessive cost incentivizes illicit payments to avoid the official fees.

He gave a compelling example: “A foreigner who cannot afford paying five thousand dollars as a fee for a work permit will stay in the country for good years… instead of paying the exact amount, for example, if it’s $5,000, he/she will prefer to pay one thousand or less than the actual amount required and that person is allowed to leave the country without paying the necessary taxes.”

The Labor Minister also highlighted a critical flaw in the fee structure: its lack of differentiation based on the sector or scale of the business. He referenced the inequity of charging a manager in a small pharmacy the same work permit fee as a manager in the large banking sector.

“If the law enacted by parliament cannot differentiate, then it will be killing certain sectors yet it also helps the government in generating revenue through taxes,” Mai argued, urging lawmakers to consult the Ministry before fixing any fee.

The Minister call for coordination across all relevant institutions to address these labor and taxation challenges, emphasizing that consistency and a wider tax base are more important than high rates.

“Currently in the country some people are paying high taxes while others are paying low. It is better to pay low so that the country has a wider tax base than having huge tax payers’ data base who are not compliant with the law.”